Rural Land Market Report 2024

Today I publish my annual analysis of large-scale rural land sales in 2024. It follows earlier reports for 2020-22 and for 2023. One of the key issues raised in the report and in this blog is covered by the Guardian today.

You can dowload a copy of the report here (it is short – only 9 pages).

The report analyses all land sales of over 500 ha in extent that took place in 2024 and includes those sales of less than 500ha where the new owner already owns over 500 ha (or as a consequence now does). In total, 39 landholdings are in scope covering 45,601 ha (0.62% of rural Scotland). Of these, 16 were larger than 500 ha and 23 were less but qualified as they were acquired by owners who already (or as a consequence) owned more than 500 ha.

Just under half of this extent (49.6%) was acquired by persons who already own land in Scotland and this continues to be a key explanation for the ongoing concentration of privately-owned rural land.

A total of nine estates of over 1000 ha were sold covering 36,090 ha and accounting for 80% of the hectarage of land in scope sold

The largest landholding sold was Dunbeath Estate in Caithness (14,361 ha) which was sold to a company controlled by a corporate trustee company and where we thus still do not know the beneficial owner.

The data in the report speaks for itself but in this blog I want to highlight three things.

ACCURACY

For the second year in a row, the number of landholdings over 1000 ha in extent being reported by this analysis (which is the result of examining each individual title over the course of 2025) is far greater than the number being reported in the Scottish Land Commission’s Rural Land Market Data report. In 2024, the SLC reports 6 such properties when in fact there were 9. In 2023, the SLC reported 5 when in fact there were 12. Over the 5 years of reporting, the SLC has reported a total of 32 when in fact there were 46.

IMPLEMENTATION OF MISSIVES

For the second year in a row, the report notes that there is a continuing use of the term “Implementation of Missives” in deeds as the consideration for the transfer of ownership.

I highlighted this in last year’s report and explained the issues in more detail in two recent blog here and here.

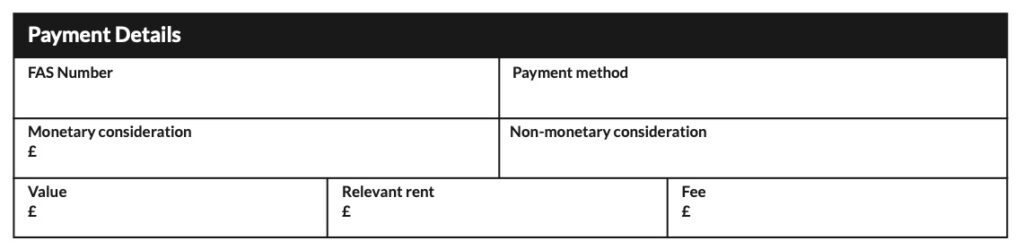

Section 12(2) of The Land Register Rules etc. (Scotland) Regulations 2014 stipulates that the consideration and the date of entry must be entered in the proprietorship section of the title sheet. The ordinary interpretation of this is that where land is sold for money, that the sum of money is the consideration. This is why on the Application Form for land registration, applicants are asked to fill in either the monetary or non-monetary consideration boxes (see extract from form below).

However, some agents are entering a non-monetary consideration (Implementation of Missives) in cases where the land has been sold for a monetary consideration. I believe this is a breach of the duty of care owed to the Keeper by solicitors and since she is duty bound to enter whatever consideration is narrated in the deed.

This is not in the spirit of the 2014 regulations, is not transparent and is adversely impacting on any meaningful analysis of land market trends.

I understand that following enquiries from the Guardian earlier this week Ministers have asked the Keeper of the Registers of Scotland to look at this issue and indeed I received an email from her on Thursday 5 February. I welcome this.

My preferred solution to this issue is to amend the 2014 Regulations to make clear that where money is being paid for land and property that it the duty of solicitors to disclose that to the Keeper as a monetary consideration.

I have written to Mairi Gougeon (Minister with responsibility for land reform and Ivan McKee (Minister with responsibility for the Registers of Scotland) to invite them to fix this along the lines suggested above. See text of letter at end of this blog. If you support this, I encourage you to write in similar terms. You can see the relevant emails to use in the pdf links to the letters.

CONCEALED PRICES

Of the nine (>1000 ha) sales that took place in 2024, five had the consideration “Implementation of Missives” (in 2023 there were 12 of which nine included it) and thus the prices were concealed. In order to find out the actual price paid, I decided to purchase the Application Forms submitted by agents in relation to these and other sales back to 2022 – 19 in total. On the Form there is a field called “Value” (see extract above) which is to be completed with the market value of the transaction. Ordinarily this is the sale price but this information is not required to be disclosed on the title sheet and is thus ordinarily unavailable to anyone inspecting the Land Register.

Each application costs £30 to obtain from Registers of Scotland and to find out the relevant sales prices I needed 21 of them at a total cost of £630. I don’t have that kind of money but some of you dear readers very kindly agreed to donate towards the cost. I credit you in the report (except where you have asked to remain anonymous). As a consequence I now have the actual prices that were paid. They are set out in Annex II of the report.

You can browse them at your leisure but they contains some interesting revelations. Above all they show the high prices being paid for some of these landholdings with 12 paying over £14,000,000 although two are forests and that price will include valuable timber (Waterhead of Dryffe – £28m and Glen Shira – £28m).

The 6300 ha Glen Dye grouse moor which consists solely of upland moorland was sold in June 2021 by the Gladstone family to the Firm of WAC Thomson and Co. for £6,200,000. That is a matter of public record and was disclosed on the title sheet. A mere 6 months later, however, in December 2021, the same land was sold to Par Forestry IV Holdco Ltd with the stated consideration of “Implementation of Missives”. This acquisition was funded by Aviva insurance and was publicised at the time as a bold and ambitious natural capital project. What few people knew, however, (until today) was the extraordinary price that was paid – a whopping £35,262,295 representing a six fold increase since Thomson bought it earlier in the year.

Other notable sales include two estates acquired by subsidiaries of Oxygen Conservation Ltd. (Dorback and Blackburn & Hartsgarth which were acquired for £28,495,220 and £14,250,000 respectively.

Even the John Muir Trust was using this mechanism. We now know the purchase price of Kylesku Chalet Park was £1,730,000. Then Trust also acquired a new 166 ha holding at Kylesku in September 2025 which consideration is again stated as “Implementation of Missives”.

It is time to end this practice. if you agree with me, please write to your MSP and/or to the Ministers concerned.

LETTER TO SCOTTISH MINISTERS (pdf copies here)

Dear Cabinet Secretary,

I am writing to you to highlight a growing problem with transparency in land transactions in Scotland. As reported in my most recent Rural Land Market report, an increasing number of large and high value sales of rural property are entering a consideration of “Implementation of Missives” in the deed which is then transferred to the title sheet. (1) Despite the fact that these sales are for a monetary consideration, a non-monetary consideration is being used to conceal the price being paid.

Section 12(2) of The Land Register Rules etc. (Scotland) Regulations 2014 stipulates that the consideration and the date of entry must be entered in the proprietorship section of the title sheet. The ordinary interpretation of this is that where land is sold for money, that the sum of money is the consideration. This is why on the Application Form for land registration, applicants are asked to fill in either the monetary or non-monetary consideration boxes.

However, some agents are entering a non-monetary consideration (Implementation of Missives) in cases where the land has been sold for a monetary consideration. I believe this is a breach of the duty of care owed to the Keeper by solicitors and since she is duty bound to enter whatever consideration is narrated in the deed.

This is not in the spirit of the 2014 regulations, is not transparent and is adversely impacting on any meaningful analysis of land market trends.

I understand you have asked the Keeper of the Registers of Scotland to look at this issue and indeed I received an email from her on Thursday 5 February.

My preferred solution to this issue is to amend the 2014 Regulations to make clear that where money is being paid for land and property that it the duty of solicitors to disclose that to the Keeper as a monetary consideration.

I am grateful for your attention to this matter.

Best Wishes

(1) See [link to this blog and report]

Dear Andy Wightman, I have followed your work for years and I am glad that you are still researching this. It was devastating when you had to leave Hoyrood although you were absolutely right to do so.

I used to contribute to your Who owns Scotland but the emails seem to have stopped. I am happy to contribute annually if necessary.

I did a quick trawl through some of the companies .which acquired the estates listed, on the Company House website. It is extraordinary to see the amount of trusts/ investment companies within companies who make up these holdings. One director at Kenmore Hospitality Ltd is located in Texas. Alexander Gerko who acquired Kinlochew & Lochrosque is a British born Russian billionaire., etc etc. How can this be tolerated? I am not even a Scot, although I might deserve that title having lived here for around 48 years.

Finally, I would be very interested in your take on Anders Hölch Povlsen, who now appears to be the darling of some access and wild land campaigners. Personally I think there is something amoral and patriarchal about one ultra rich person holding so much land, particularly as that would not be possible in his own country, but some of my friends disagree with me.

Anyway, I thank you for your continuous work.

Mireille

Thanks Mirielle. I have no views about Anders Povlsen – he is acting lawfully. IF what he is doing is wring then it is our job to change the law but for so long as he can buy as much as he likes, he may well do. The proposal for a cap was rejected by Ministers although there is a more workable solution I think…

Hi Andy

I am happy to pay for 3 fees , I am a great admirer of your work keep it up.let me know how to pay .

Stewart, thanks but I raised enouugh for the purposes and then a bit more.

Good morning Andy

Very glad you continue to research these important questions and despite the hurdles put in your way. Its pretty extraordinary that Par Forestry should have paid £35mn, a six-fold increase on the sale price earlier that year. What might explain this do you think?

Will forward letter to Cabinet Secretary and also happy to contribute when a new pot is needed for further enquiries at Land Registry Scotland.

Camilla

Cabinet secretaries

prefer large landowners , the larger the better. Foreigners even better.

They reward them with seven figure sums of public money to spend as they please as a reward for owning lots of scotland.

They wont rest until Scotland is rid of all pesky peasants.