Land Reform (Scotland) Bill and the £25 million Estate

As readers may be aware, I run the Who Owns Scotland project. It documents the ownership of over 76% of rural Scotland. The information is updated annually and where there is a change I often need to order a deed (costing £30). Because of the expense, I only do this for major sales. For minor ones, I note the change and update records when the information becomes available on the Land Register.

The day after the Scottish Parliament voted to pass the Land Reform (Scotland) Bill, I received a deed I had ordered from Registers of Scotland. It was the first large scale transaction I had come across since the Bill passed and it presents an interesting example of the impact that the Bill might have.

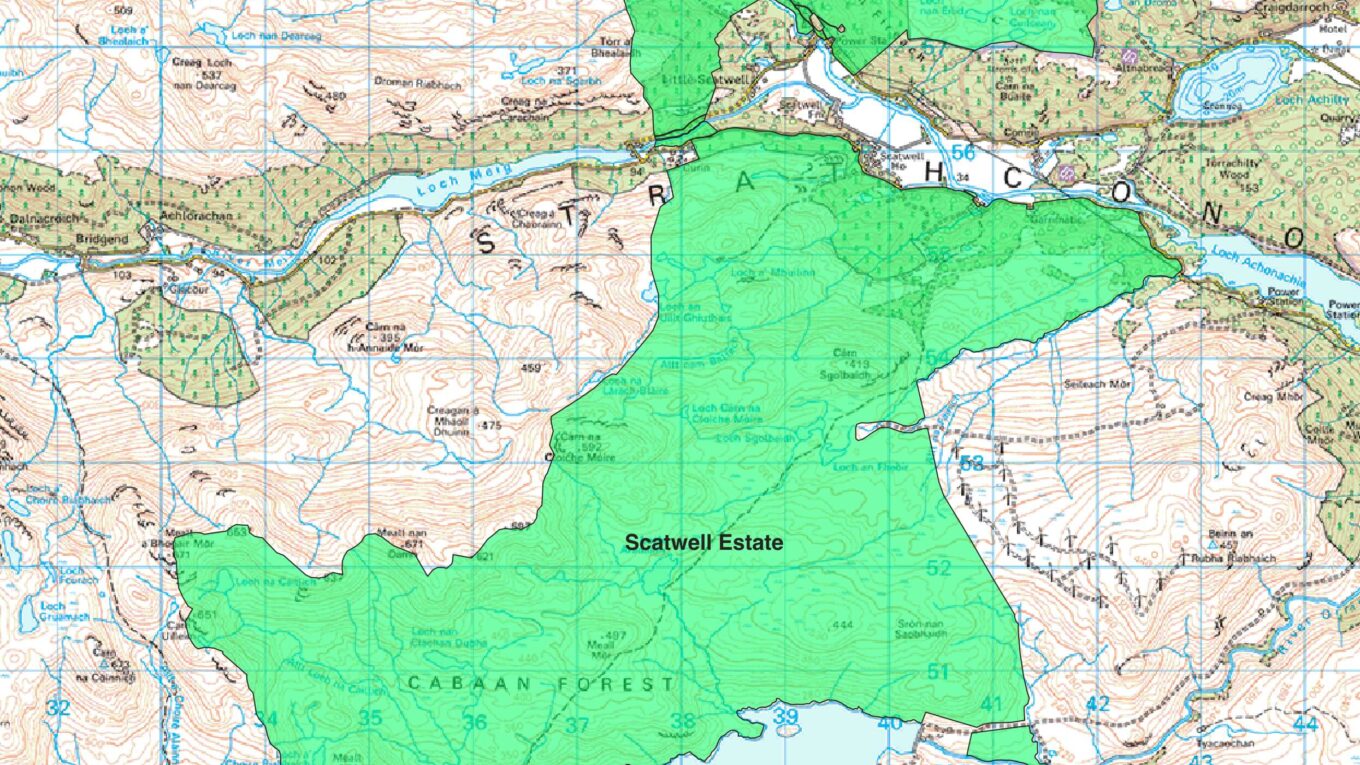

The deed conveys 3525 hectares (ha) of land in Ross & Cromarty comprising the majority of Scatwell Estate at the foot of Strathconon. The sale excluded Scatwell House, low ground, and all estate buildings and consists solely of high hill ground and some woodland (see map at top of this blog). Two features stand out about this sale (there is an interesting third one which I will discuss in my next blog).

The first is the price.

This 3525 ha sold for an astonishing £25,200,000 (£7149 per ha). At the peak of the recent bubble in land prices, hill land suitable for tree planting (much of this land is not) reached £5,500 per ha. Estate sales peaked at £8.8 million [1] The market value of this land is probably closer to £7 million.

The second is who acquired it.

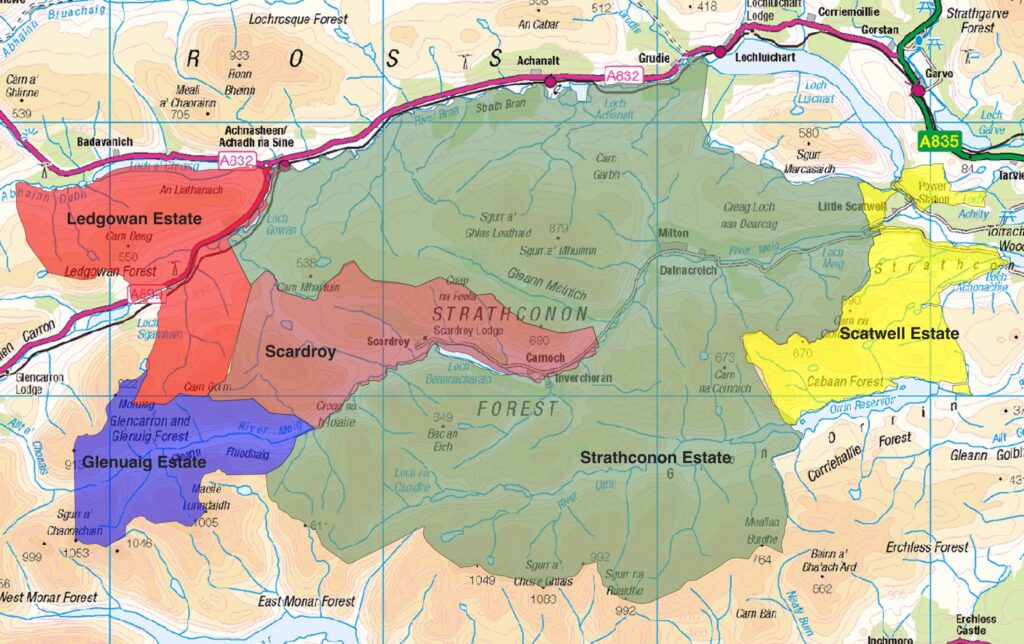

It was purchased by Strathconon Estates Ltd., a company controlled by billionaire Lego heiress Sofie Kirk Kristiansen. Sofia’s father, Kjeld Kirk Kristiansen, bought the 28,448 ha Strathconon Estate in 1995 via his company Kirkbi Estates Ltd. This was followed by further acquisitions of neighbouring estates.

In 2013, Kirkbi bought Scardroy Estate (4205 ha) for £5,550,000

In 2017, Kirkbi bought Ledgowan Estate (4490 ha) £4,501,000

In January 2023, Sofia obtains control of the company as the majority shareholder and changes the name to Strathconon Estates Ltd.

In June 2024, the Glenuaig Estate to the west (2962 ha) was put on the market and bought in March 2025 for £7,150,000

Finally, the 3525 ha of Scatwell were bought in September 2025 for £25,200,000.

Strathconon Estate has grown from 28,448 ha in 1995 to 42,730 ha today. This is one example of the growing concentration of private rural landownership in Scotland in the past decade.

But now would the Land Reform (Scotland) Bill, if it had been in force since the beginning of 2023, have affected any of this activity?

Strathconon Estate

The change of ownership from Kjeld Kristiansen to Sofia in 2023 was achieved through the reallocation of shares in Strathconon Estates Ltd. Ownership as a matter of law did not in fact change. It remained with Strathconon Estates Ltd. Such changes in control are exempted from the provisions of the Land Reform (Scotland) Act 2003 (as amended by the current Bill). Thus the Bill has no impact at all.

Glenuaig

As the map above shows, this is a tract of land to the west of Strathconon upon which nobody lives. There is no known community body in the vicinity and even if there were, it is unlikely that they could raise (far less justify) paying £7,150,000. it is also unlikely that a lotting decision would be made. Ministers can only make a lotting decision if it is in the public interest and that test will not be met according to (inserted) Section 67N of the Bill, unless

Ministers are satisfied that ownership of the land being transferred in accordance with the decision would be more likely to lead to its being used (in whole or in part) in ways that might make a community in the vicinity of the land more sustainable than would be the case if all of the land were transferred to the same person.

As noted above, there is no community in the vicinity and no lotting decision would be able to be made. Lotting cannot be done.

Scatwell

The £24.2 million sale of Scatwell highlights similar issues.

The nearest community body is in Muir of Ord and the area from which it draws its members is the primary school catchment area for the village. The boundary of this is some 8 miles away from Scatwell and, although the constitution of Muir of Old Development Trust allows it to acquire property anywhere in the world, any late registration has to meet the following criteria,

- be in the public interest

- have a significant number of members having a connection with the land and;

- that the land is sufficiently near to land with which those members have a connection.

These are all statutory tests that must be met. I very much doubt that they could be for an organisation none of whose members live anywhere near Scatwell. Moreover, even if it could by some stretch be considered appropriate, it is doubtful if any community body would have such use for the land in question, never mind be able to justify paying £25.2 million for it.

Lotting faces the same statutory hurdles set out above in relation to Glenuaig. Even if a lotting decision were to be made, the land may well be bought by some of the corporations that are buying land across Scotland leading to ever increasing concentration (the opposite of the aims of the lotting provisions). Furthermore, none are likely to pay in aggregate for two or three lots anywhere £25.2 million and thus Scottish Ministers will, according to the legislation, face paying compensation to Heneage James Daniel Finch-Knightley, Lord Guernsey and Charles Heneage Finch-Kinghtley, Lord Aylesford (the seller) of over £10 million.

The Bill will, of course, require Strathconon Estates Ltd. to prepare a management plan for the estate and engage the community in this endeavour. This will bring some welcome transparency although it should be noted that there is no requirement to implement the plan. The estate is managed as part of Sofia’s Earthkeeper project, described on Strathconon’s website as follows.

- Earthkeeper is a set of practical and professional frameworks for a deep love for nature and a sense of oneness with every living being in it.

- Earthkeeper works to conserve and restore authentic ecosystems. In terms of science, this means contributing to ensuring the survival and well-being of species in their natural environment. In terms of energies, it means maintaining a primordial and loving resonance in the world.

- At the heart of Earthkeeper is a desire to make a difference for nature and its creatures, great and small.

As a coda to all of this, the non-domestic rating valuation for the Scatwell deer forest is £5700 meaning that on this £25.2 million parcel of land, the billionaire owner is liable for just £2838.60 annual rates bill. This is less than a Council Tax Band F house in nearby Maryburgh on the market for offers over £220,000. This low rateable value also makes the owner eligible for 100% rates relief available through the Small Business Bonus Scheme meaning the company would pay no rates at all. This relief was claimed in 2019 but I have no information on whether it has been since. [2]

Were the liability to be set at the same percentage of the value of the Band F house, the annual liability would be over £327,000.

For completeness, it is also worth noting that the Land and Buildings Transaction Tax liability on this sale would have been £1,248,500 payable to Revenue Scotland.

Scatwell is only one example of course. I hope to review all land sales (several hundred) in scope of the Bill from 2024 and do a proper analysis of what might have happened had the Bill been in force that year.

NOTES

[1] See this briefing from SRUC.

[2] It is unlikely that such relief may be available now since the aggregate valuation of all the rateable proeprties across the entire estate is probably now in excess of the threshold for relief. Nevertheless, the point stands in relation to this 3525 ha of land in isolation.

I feel justified buying Chinese Bootlego bricks now.

Andy,

Warm thanks for your scholarly analysis.

Could you kindly explain the term ‘members having a connection with the land’?

Thank you.

Bruce

Those are the words in the legislation. It is for the courts to interpret them if there is any doubt. I am not sure how they have been intepreted to date in the commmunity rights to buy that have been successful

Have we got a Scottish government who are awake to what is happening to OUR land. Have we got a Scottish government who are awake and aware of all the dodges these parasites get up to ? Answers on the back of a fag packet…

Think about setting up an account for donations so money is available for your research / battle plans…etc. I assume the foreign/hidden owners of these huge tracts of OUR land are not short of a bob or two….you will need help. We are here.

Apparently not.

Andy

Did you ever do a blog on the lochrosque and Kinlochewe estate sale?

No, I have not. But ut is all recorded at http://www.whoownsscotland.org.uk. IS there anything significant about it other than rich Russian buys land in Scotland?

perhaps it is time for a taxation on landownership per acre according to latest purchase price/evaluation?

another law change that would be welcome is perhaps to prevent non UK residents/citizens to own land.

This is interesting, especially in the light of that Denmark prohibits non-citizens/residents to acquire ANY kind of property.

In the times that we live in, foreign ownership of a country’s assets could and should be considered a political safety risk.

Andy, do you (or anyone reading this) have any insight why the price for this land (and others you highlighted recently) are so much more than market value?

You could try reading Andy’s earlier post “The £12 million farm sale and the £14 million lease” and the subsequent comment by Peter Smith.

NO. Am trying to find out but it depends on accessing sensitive iinformtaion from the parties as to how it came about. Couple of journalists on the chase but dont expect to ever find out.

Looks like she’s prepared to pay anything to get ownership of properties adjacent to those she already owns. Presumably there were other bidders or she wouldn’t have had to go so high. It would be interesting to know who those bidder were, if there were other bidders, and why they wanted Scatwell. It would also be interesting to know if she intends to sell /is selling carbon credits from her properties. If so, that might offset some of her costs although I suspect it’s unlikely to result in a financial profit from the purchase, especially at that price. So it seems unlikely that the pursuit of land to generate carbon credits fueled a bidding war that resulted in the high sale price.

I doubt there were other bidders as it is hard to see how anyone other than SKK would bid anything over £5-10 million since the carbon bubble has (at least temporarily) burst.

Thanks for more good investigative work Andy. Looking at how other countries tax land leads me to ask why it matters if owners are citizens or residents. If, for example, the two Danes who own large amounts of land in Scotland lived in Denmark (or elsewhere) but paid tax on their land holdings here instead of / as well as in Denmark, what difference would it make – assuming Scotland introduces relevant law? Appreciate hearing views on the matter.

Very informative article and well presented thank you.

The owner’s motivation is probably not financial at all and if there is any financial gain that is just incidental. In fact it is quite possible that there is a loss-making element to the whole Strathconon project. People have bought large sporting estates simply for conspicuous leisure and are willing to subsidise them externally. If SKK / earthkeeper are investing in improving our environment, does it matter if the owner is a Danish billionaire? Isn’t this a way of wealth being shared to create public interest outcomes? If the land was still managed as a large sporting estate with ascribable environmental damage then that would change the situation.

Also I can’t see any windfarms on these estates, something that many local people (and wider interest communities) are against so may be at least on this count it is a positive outcome.