You were never meant to know about the £25 million estate sale

In my previous blog highlighting the £25.2 million sale of Scatwell Estate to Strathconon Estates Ltd, I mentioned a third interesting feature of the sale.

You were never meant to know about it.

I have been meaning to write this blog for some time and the Scatwell sale has prompted me to get on with it. In my Rural Land Sales 2023 report, I noted that in an increasing number of large-scale land sales, the “consideration” entered in the Land Register is “Implementation of Missives”. This blog explores this in more detail and explains why any reference to the £25.2 million paid for Scatwell will soon disappear from the public record.

In all land transactions, a deed is drawn up – typically by the seller’s solicitor. For a transfer of ownership, this document is know as a disposition. It will set out the identity of the buyer, the seller, the land being disposed and any relevant title conditions. The form of this deed has evolved over time but is now pretty much standardised.

Deeds are submitted to the Keeper of the Registers of Scotland and are the basis upon which a Land Certificate is prepared and ownership entered in the Land Register.

An important part of the deed is the “consideration”. This refers most commonly to a monetary consideration but non-monetary ones are also used. For example,

- Love, Favour and Affection refers to a gift typically to a relative.

- Conveyance to Beneficiary refers to a transfer of ownership to the beneficiary of a trust

- Implementation of Will refers to a transfer following instructions set out in a will. [1]

These are all well understood terms in long-standing use.

Implementation of Missives

“Implementation of Missives” is also, according to Registers of Scotland, a term that has been in use for a long time and has been an option for use in land registration applications since the Land Register came into being in 1981. In contrast to the examples above however, it is pretty meaningless. Missives are the contracts exchanged in every property transaction and their implementation is merely the completion of the process once ownership legally changes. In other words, every successful transfer of title is a consequence of the implementation of missives.

Nevertheless, In my research, I have noted its appearance more frequently in recent years in relation to large-scale land transactions. Such transactions will involve the payment of money but rather than the sum being entered as the (monetary)consideration, implementation of missives (a non-monetary consideration) is being used instead.

Examples of such sales include;

- Glen Dye Moor (6364 ha) acquired by Par Forestry IV Holdco Ltd. in 2021

- Glen Lyon Estate (2442 ha) acquired by Kenmore Hospitality Ltd. in 2022

- Abergeldie Estate (4703 ha) acquired by Caerd Ltd. in 2022 (see header image)

- Lochrosque, Cabuie & Fada (15,515 ha) acquired by Alexander Gerko in 2023

- Kylesku Chalet Park (18 ha) acquired by the John Muir Trust in 2023

- Dunbeath and Glutt Estate (14,361 ha) acquired by Dunbeath Estates Ltd. in 2024.

- 23 properties (8768 ha) acquired by Gresham House partnerships between 2017 and 2025.

- Two estates (Blackburn & Hartsgarth and Dorback) (10,626 ha) acquired by Oxygen Conservation in 2023 and 2024.

These examples are a selection of the 109 sales that I have identified in the past few years covering 121,225 ha of land across Scotland.

Of the 12 estates over 1000 ha in extent changing hands in 2023, for example, 8 gave Implementation of Missives as the consideration.

The Land Registration Process

Accompanying every application for land registration is a form. As part of that form the agent is required to enter the monetary or non-monetary consideration (see extract below). They are also required to enter a value.

If I owned a house (worth £250,000) and sold it to my sister for £10, I would expect to see £10 as the monetary consideration and £250,000 as the value. The value is required by the Keeper in order for her to charge the appropriate registration fee. Currently, a property with £250,000 would pay £530. All transactions in excess of £5 million pay a fee of £8250. The value is also required for assessment of Land and Buildings Transaction Tax liability.

Section 12 of the Land Register Rules etc. (Scotland) Regulations 2014 sets out the information that is required to be entered in the Land Register. Section 12(2) provides that the consideration and date of entry be displayed on the Title Sheet which is available for public examination (but not the value).

Standard practice where a property sells for £10 million would be to enter this in the monetary consideration field of the application form and, where this is equal to the value (which in most cases it will be), that sum is entered in the value field. However, it is clear that in a growing number of large-scale transactions, the price paid for land is being concealed by entering a non-monetary consideration of “Implementation of Missives”. Although the price paid will be entered in the value field, this figure does not require to be displayed on the title sheet and is thus concealed from the public record.

This appears to be the intention behind the growing use of this term in large-scale land sales.

The £25.3 million sale you were not meant to know about

And so to the sale of Scatwell Estate I wrote about in my previous blog.

When transactions take place, they are logged initially in the Application Record before being processed and entered on the Land Register. This can take up to four years.

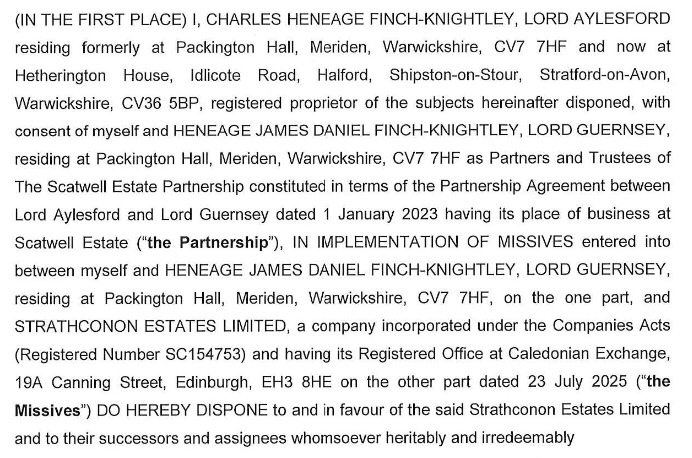

When I examined the Deed for the sale, there was no monetary figure mentioned anywhere and the consideration was given as Implementation of Missives (see below)

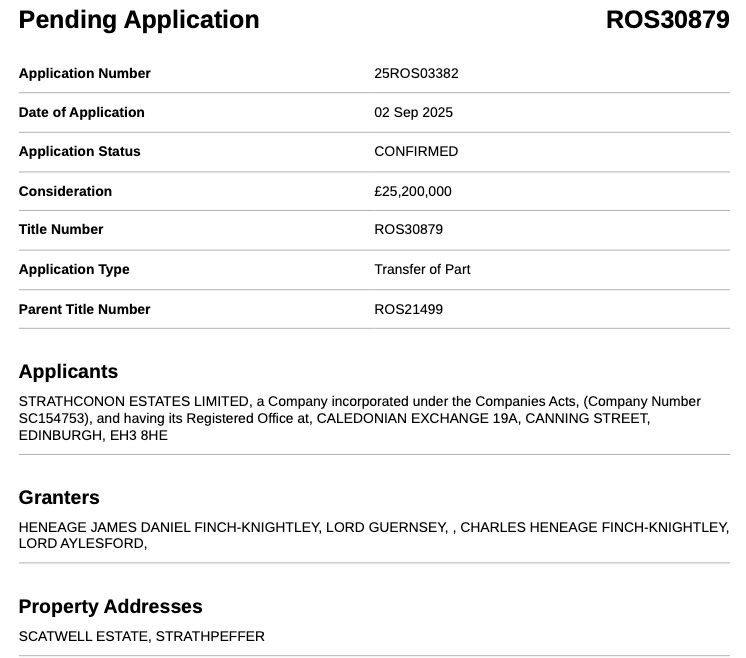

Examining the Application record for the sale, however, I noted the figure of £25,200,000 entered as the consideration (see below).

Ordinarily, the consideration would be derived from the deed and “Implementation of Missives” would appear here as it does in all of the other titles I have examined. However, the applicant in this case (Lindsays soliticitors) entered (by mistake it would appear) the £25.2 million sum in the monetary consideration field of the Application Form rather than the Value field. This was then carried over automatically into the consideration field of the Application Record and thus revealed the price paid when it was intended to be concealed.

Once the land registration process is completed, the consideration will show “Implementation of Missives” and the £25.2 million figure will be nowhere to be seen. Had no-one examined the Application Record, knowledge of the price paid would never have been made public.

Why This Matters

And this is the key issue.

The reason why there is reliable and regular information on house prices is because the prices are entered as the consideration. If, instead, the consideration if given as “Implementation of Missives”, then no such information would be available to inform buyers and sellers.

Significant effort has been made over the past few years to better understand the dynamic of the rural land market and large-scale landholding transactions in particular, The Scottish Land Commission published research on the topic and I have published an annual report since 2022 (the 2024 report will be published in January 2026). Without knowing the price that land is being sold for, it is impossible to monitor and analyse market trends for policy making purposes.

It is important to stress that the prices do exist – in the value field of the Application Form. But this figure is used purely for internal administrative and tax purposes and is not required to be published on the Title Sheet. It is therefore concealed from the public.

I will be submitting a Freedom of Information request to the Registers of Scotland for the values associated with the 25 or so large scale land transactions over the past 7 years. It will be open to the Keeper to reject such a request given that the information could be argued to be otherwise available under Section 25 of the Freedom of Information (Scotland) Act 2002.

However, that would involve paying £750 for copies of all the associated Application Forms (25 forms at £25+VAT each). Whether that counts as reasonably obtainable under Section 25 of the Freedom of Information Act(Scotland) Act 2002 will then become the issue.

Future Reform

Given the public interest in monitoring land sales, there needs to be reform to the Land Registration Rules. The simplest way of doing this would be an amendment to Section 12(2) to require that the value be displayed on the title sheet. Alternatively, the Keeper could use her existing discretionary powers to stop recognising Implementation of Missives as a legitimate consideration where such transactions involve a price being paid.

However this is achieved, it is not acceptable to conceal the price being paid for vast extents of land when every homeowner reveals the price they pay for their modest dwellings.

NOTES

[1] For the considerations recognised by the Keeper, see Part A fields – payment details here

Well done yet again Andy Wightman. Another important fact about Scotlands land sales revealed to us punters! Good luck with the FOI request.

Is the Scottish Government aware of what is happening to OUR land? Do they actually care. Just as well we have Andy watching and asking questions. We really have to do something about these creatures who regard Scotland as part of their investment portfolio. Are they even Scottish? That’s a rhetorical question..no answer required..of course they are foreign and no doubt hiding behind ‘scottish ‘ sounding names assisted by the quislings amang us.

Our Scottish government asleep at the wheel again.

Thank you Andy..a great warrior for Scotland.

For OUR Scotland and her weans.

Why not create a more explicit entry under the heading ‘Consideration’:

“None of Your Effing Business-Pleb!”

Keep it all simple and straight forward.

Thank you, Andy, for highlighting this issue. It is a disgrace.

I’d agree that the Scatwell £25.2m disclosure was probably a mistake.

I’d like to make sure I understand your intended FOI request for the VALUES of large land transactions (VALUE used, as you clearly explain, to calculate the appropriate land registration fee).

You say “It will be open to the Keeper to reject such a request given that the information could be argued to be otherwise available under Section 25 of the Freedom of Information (Scotland) Act 2002.”

The VALUE figure on the original land registration form – which the solicitor sends in to the Registrar – isn’t in the public domain, because that form itself isn’t in the public domain.

The Application Record (£25 + VAT for each one…) is in the public domain, but only provides the CONSIDERATION, not the VALUE. And that brings us back full circle to the “implementation of missives” phrase available to any buyer/seller wishing to obfuscate a land transaction’s monetary value. CONSIDERATION is the same figure/phrase that appears on the title sheet (and available to anyone wishing to pay £3 + VAT). And again, title deeds are in the public domain, but less expensive.

In other words, I don’t think they can refuse on the basis of the information being otherwise available … 0r have I misunderstood your FOI request?

I’ll be very interested in how you get on with it, and look forward to an update. Thanks for everything you do, and a particular thanks for including John Muir Trust’s purchase of Kylesku Chalet Park on your list 🙂

Apologies if it is uncelar – this is a complicated topic!The Application Form is available for purchase at £25 + VAT. On thats basis it coudl be ssaid to be otherwise accessible but the FoI Commissioner’s decisiosn suggest that disproprtionate cost is one factor that would render this exemption invalid since if you have to pay so much money, then the information is not otherwise reasonably accessible.

Intriguing account of this transaction. Seems like there should be a small team of individuals who in turn obtain such information and then make it public. Costly but at least bringing such a transaction into the public domain.

Seems like there should be a small team of individuals who in turn obtain such information and then make it public. Costly but at least bringing such a transaction into the public domain.

The term “implementation of missives” is used where the consideration is not a straightforward fixed figure but is determined by a calculation or formula set out in the contract for the sale of the land.

Would Implementation of Agreement not be more usually used in such circumstances? I know from some instances of IoM that there was a straightforward fixed figure though there were some clawback conditions etc. How can we be sure that IoM is not being used to conceal comemrcially sensitive sale prices? Why has the use of the term increased significantly in recent years in relation to large-scale land transactions? In any event, all such transactions will have a value associated with them and it is this value that should be in the public domain.

Whether concealment of the price paid for the land is the intent or an unintended consequence, surely it needs to be stopped?

Strathconon Estate is across the Conon River from my farm.

Be good if you looked into the ownership of the Blackwater River. Runs parallel to the Conin.

All these “sales” go on around us with very little transparency.

Ian – this is now our 2nd encounter since the RBS debacle.

Brilliant work by Andy W as ever

The scottish govt is owned by the lairds, so nothing will be done.

The recent land reform bill will never be implemented , just as the 2016 has never been fully implemented.

The 2003 act was largely dismantled by the money of the landed interest.

Nothing ever changes, land in scotland is a tax dodge extrordinaire.

Are there any other examples of environmental groups, charities or public bodies using Consideration of Missives, or is the JMT purchase of Kylesku the only one to date.? Given that their members eventually found out the price, what advantage/ benefit would they have in using this mechanism?

I have not seen any and unsure why they used this term.

The bit that I find interesting about all this is that the silly prices being paid are driven at least in part by the potential for natural capital/ carbon values in future increasing, and doing things that are claimed to be in the public interest…… but the value placed on that public interest is kept a secret when possible. “Yes, I am doing all this for your benefit. No, what it is actually worth is none of your business.”

Great blog once again Andy. Very well laid out. It highlights a clear lack of transparency in the current system of land registration and provides a viable suggested route by which this particular element can be addressed through reform of the Land Registration Rules.

It feels to me like this one is a loophole in the rules being exploited by large landowners to hide sales values rather than any intention of the system design to obfuscate them. As a result it should be viewed favourably by anyone examining the issue from a public interest standpoint.

Thanks. Situation also highlights the role of the Keeper as someone who relies on solicitors acting in good faith. They draft deeds and they have evolved a series of non-monetary consideration terms which the keeper has to take on trust (soliciotrs have a legal duty of care to the Keeper). Implmentation of Missives has been in use for some time – not sure when it first appeared but unless such terms are obviously nonsense or misleading , it is not the Keeper’s business to question how conveyancing is done.