Land Reform (Scotland) Bill (3)

This is the third in a series of blogs analysing the Land Reform (Scotland) Bill 2024.

In this blog I want to begin an analysis of the impact of the intervention powers (Sections 2 and 4) in the Bill by looking at qualifying land (>1000 ha) that has been sold over the past few years. I will examine each land sale in turn and assess how likely it would have been that the Bill would have changed anything had it been in force at the time. In this blog I look at 2020 and in a subsequent two, I will look at 2021 and 2022 (and perhaps 2023). An overall analysis of the land market 2020 – 2022 can be found in this report I published in February 2024.

The purpose of this blog is to illustrate the potential impact of the Bill.

The Bill obliges any owner of land in excess of 1000 ha where they propose to sell all or part of it, to notify Scottish Ministers. Ministers can then do two new things.

Right to Buy

They can invite a community body to make a late application to register an interest (late because it is made after land is put up for sale – a timeous one would be made before that event) in the land under Part 2 of the Land Reform (Scotland) Act 2003.

The key difference this Bill makes (compared to the existing 2003 Act) is that it requires notification to Ministers of all proposed sales of qualifying land (>1000 ha). Currently, if there is no registered interest an owner is free to sell the land privately or off market without any advertising of their intention to do so. Under these circumstances, a community body would never know that the land is to be sold and thus could not make a late application. Under the Bill’s provisions for notifying Ministers, all proposed transfers will be known.

It should be emphasised that the late registration provisions of the 2003 Act still apply whereby it is only where a community body has good reasons for not having made a timeous registration that Ministers will grant them a late application. Nothing in this Bill changes the fundamentals of the way in which Part 2 operates although the timetable is a little bit more generous in the Bill’s scheme. For most sales therefore, the Bill changes nothing and any community body could apply for a late registration under the law as it stands now.

Lotting Decision

Ministers can also make a lotting decision to require that the land is sold in specified lots. Ministers can only make a decision that land must be lotted if,

they are satisfied that ownership of the land being transferred in accordance with the decision would be more likely to lead to its being used (in whole or in part) in ways that might make a community more sustainable than would be the case if all of the land were transferred to the same person (inserted section 67N).

How are the following sales assessed?

The sales are assessed according to the likelihood and impact of the two Ministerial powers being exercised had the current Bill been law at the time. I explain my reasons and you are free of course to imagine that another outcome might have come about. CRTB denotes the analysis of right to buy and Lotting denotes an analysis of any lotting decision

INVERMEARAN AND AUCH ESTATE (Argyll)

7686 ha Sold 10 March 2020 £4,180,000 for Invermearan. No price disclosed for Auch.

CRTB – this was an open market sale. The sales brochure can be downloaded here (4.7Mb pdf). Any community body that existed (there are none) could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – the land was already lotted when it went on sale. Lot 1 was Auch Estate (9250 ha) and Lot 2 was Invermearan Estate (7666 ha). Ministers could have chosen to make a lotting decision to reflect the existing lots but it is considered unlikely that it would have made any difference to the sustainability of the community.

SALE – the two lots were sold in 2020 and 2022 to the same company, Profound UK Holdings Ltd., a company ultimately owned by Mr Ming Wai Lau, Chair of Chinese Estates Holdings Ltd. and a resident of Hong Kong with British nationality.

ASSESSMENT No difference

AUCHAVAN (Angus)

1005 ha. Sold 19 March 2020 £3,250,000

CRTB – this was (to the best of my knowledge) an off market sale. Any local community body (none exists to my knowledge) would not have known about it. The notification duty in the Bill would have alerted them and Ministers might have invited them to submit a late application. It is hard to see the community interest in this estate

LOTTING – the estate consists of a number of dwellings. These could have been made subject to a mandatory lotting decision by Ministers to provide greater housing opportunities. Had they done so, however, it is unlikely any locals would have been able to afford properties which, in all likelihood would have been sold as second homes.

SALE – the estate was sold to Auchavan LLC, a company registered in Delaware, USA and controlled by Texas hotelier Archie Bennet who already owned the neighbouring Glencally Estate through a limited partnership registered in Delaware, USA.

ASSESSMENT – 10% likelihood of the Bill making a difference.

KILCHOAN ESTATE (Inverness-shire)

4514 ha. Sold 25 March 2020 £3,952,472

CRTB – this was an open market sale. Any community body that existed could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – the land was lotted in 3 lots when it went on sale. Lot 1 was for the main estate and Lots 2 and 3 were sporting leases. Ministers could have chosen to make a lotting decision to make some of the properties available to buy separately. There is a shortage of housing on Knoydart but such houses may have ended up as holiday homes rather than homes for local people.

SALE – the estate was sold to Christopher Henkel from Austria and further shares are owned by a umber of individuals with registered addresses in Jersey.

ASSESSMENT – 20% likelihood of the Bill making a difference.

KILDRUMMY ESTATE (Aberdeenshire)

2293 ha. Sold 31 March 2020 undisclosed sum.

This estate was owed by Kildrummy (Jersey) Ltd. before being taken over by Christopher and Camile Bently from California. The estate was offered for sale and the brochure can be downloaded here (6.7Mb) through the purchase of shares in Kildrummy (Jersey) Ltd. with the Bentley’s acquiring the shares. With 12 tenant farms, a hotel and 12 further domestic dwellings, there would have been a strong case for Ministers making a lotting decision. The sale of shares in the Jersey-based company, however, is not a transfer within the meaning of the Bill and thus none of its provisions would have been engaged

ASSESSMENT – No difference (not within the scope of the Bill).

GLEN SPEAN ESTATE (Inverness-shire)

2828 ha. Sold 15 April 2020 for £792,500.

CRTB – this was an open market sale. Any community body that existed (none is known to) could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – It is considered unlikely that and lotting decision would have made any difference to the sustainability of the community and thus Ministers would not be able to make one.

SALE – the estate was sold to Stonethorn Farms Ltd. from Northern Ireland.

ASSESSMENT – No difference.

BUNLOINN FOREST (Inverness-shire)

2010 ha. Sold 22 April 2020 for an undisclosed price.

CRTB – this was (to the best of my knowledge) an off market sale. Any local community body (none exists to my knowledge) would not have known about it. The notification duty in the Bill would have alerted them and Ministers might have invited them to submit a late application. It is hard to see the community interest in this estate is as there is no-one living on it or close to it.

LOTTING – It is considered unlikely that and lotting decision would have made any difference to the sustainability of the community (there is no community) and thus Ministers would not be able to make one.

SALE – the estate was sold to John Ford and Co. Ltd., a private company registered in London. The estate is the subject of a planning application for a 66Mw, 10 x 200m high wind turbines.

ASSESSMENT – No difference.

THE BARRACKS PLANTATION (Perthshire)

4475 ha. Sold 10 September 2020. £23,500,000

CRTB – this was an open market sale. The sales brochure can be downloaded here (5.3Mb pdf) and the plan here (3.4Mb pdf). Any community body that existed could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – this property was marketed in five lots. Given that it was owned by Scottish Ministers, it is problematic to think they could impose a different lotting decision on themselves and so unlikely that any such decision would have been made.

SALE – the forest was sold as a whole to Commercial Forestry LLP

ASSESSMENT – No difference.

SCALPAY, LONGAY & GUILLAMON (Inverness-shire)

2654 ha. Sold 15 September 2024. No sales price disclosed.

CRTB – this was (to the best of my knowledge) an off market sale. There is a local Development Trust, Broadford and Strath Community Company, within whose area the three islands lie. The notification duty in the Bill would have alerted them to the sale and Ministers might have invited them to submit a late application. A successful late registration has to meet a high threshold under the 2003 Act and the Community Company to my knowledge has never expressed an interest in buying the islands.

LOTTING – Ministers could have imposed a lotting decision if it would have made a difference to the sustainability of the community. The islands are not economically important in the community life of South Skye but even if a lotting decision had been made, the islands would probably have been sold to absentee owners.

SALE – the islands were sold to Scaplay Ltd., a company registered in the Bahamas.

ASSESSMENT – 15% chance of Bill having made a difference.

GLEDFIELD ESTATE

2654 ha. Sold 12 October 2020. £4,600,000

CRTB – this was a private off market sale. There is a community body, Kyle of Sutherland Development Trust but with a range of existing projects and liabilities, it is highly unlikely that they would have been in the market for a £4.5 million estate.

LOTTING – Ministers could have lotted the estate by perhaps lotting the mansion house and policies separately from the hill ground but it is unclear how that would have made the community more sustainable which is the criteria against which Ministers much make such a decision.

SALE – Gledfield Estate was sold to Gledfield Highland Estate Ltd., a subsidiary of the Pure Leisure Group.

ASSESSMENT – 5% chance of the Bill having made a difference.

GLENVICASKIL FOREST

1398 ha. Sold 19 October 2020. £2,025,000

CRTB – this was an open market sale. Some brief sales details can be seen here. Any community body that existed could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – this property one of two lots offered for sale by Scottish Ministers. Given that it was owned by Scottish Ministers, it is problematic to think they could impose a different lotting decision on themselves and so unlikely that any such decision would have been made.

SALE – Glenvicaskil Forest was sold to Christopher McDowell from Northern Ireland.

ASSESSMENT – No difference.

URLAR ESTATE

3023 ha. Sold 10 November 2020. £7,750,000

CRTB – this was a private off market sale. There is a local development trust, the Aberfeldy Development Trust. Had the Bill been in force in 2020, it is likely that they would been notified. However, it is unlikely that a case could have been made for a late registration and the price (£7,750,000) would have been difficult to justify or to secure.

LOTTING – Ministers could have made a lotting decision but it is hard to see how it could have been justified by the sustainability criteria and may have exposed Ministers to a claim for compensation if the sale price of the whole (£7,750,000) was no achieved by the seller (an Irish accountant and financier).

SALE – Urlar Estate was sold to TOF Corporate Trustee Ltd., the corporate trustee of Oxford University Endowment Management Ltd.

ASSESSMENT – No difference.

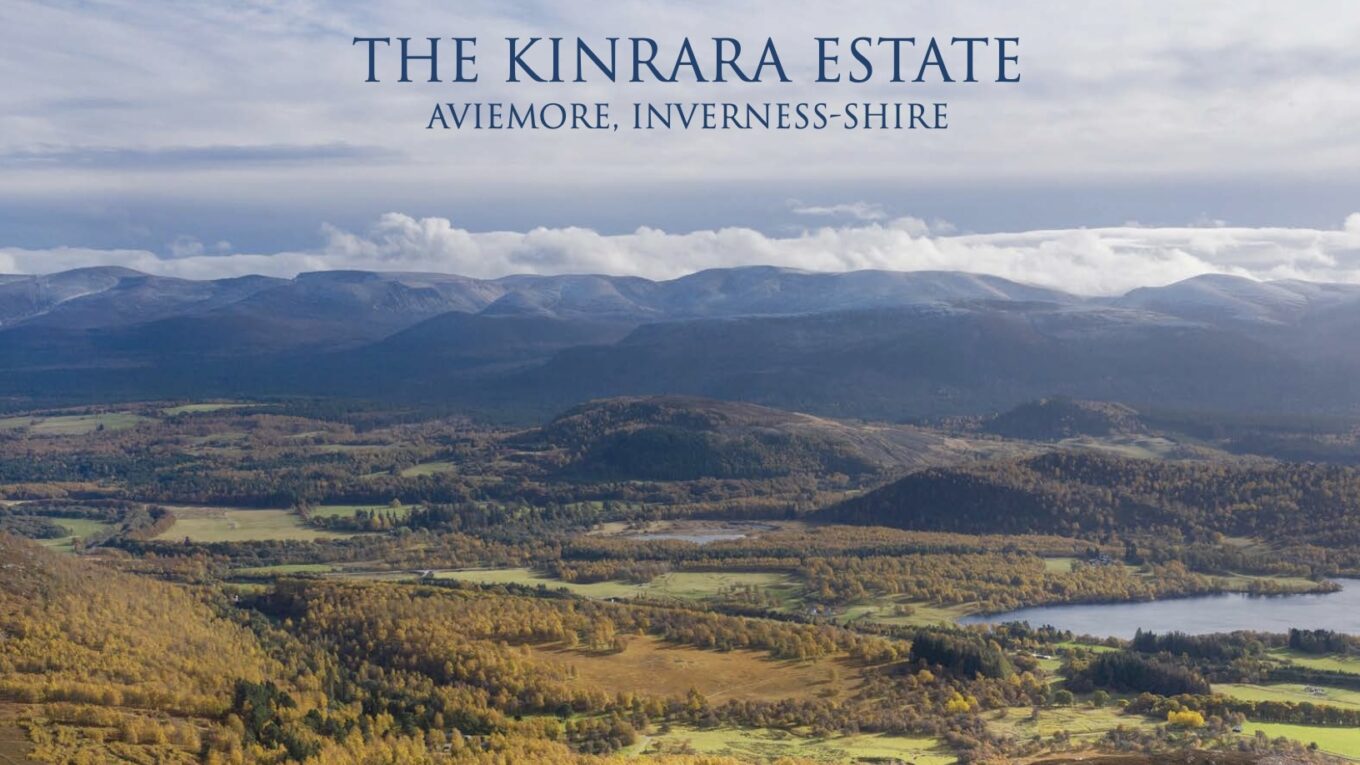

KINRARA ESTATE

3764 ha. Sold 29 December 2020. £8,800,000

CRTB – this was an open market sale. The sales particulars can be downloaded here (2.3Mb pdf). Any community body that existed could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – Ministers could have made a lotting decision but it is hard to see how it could have been justified by the sustainability criteria and may have exposed Ministers to a claim for compensation if the sale price of the whole (£8,800,000) was no achieved by the seller.

SALE – Kinrara Estate was sold to Lost Forest Ltd, a subsidiary of the Brewdog beer company.

ASSESSMENT – No difference.

ACHAGLASS

1058 ha. Sold 30 December 2020. £8,730,000

CRTB – this was an open market sale. The sales particulars can be downloaded here (4.2Mb pdf) and the plan here (2.7Mb pdf) Any community body that existed could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – this property was sold in two separate transactions two years apart and therefore may not be caught by the scope of the Bill. Nevertheless, there is little evident looting that can be done to improve the sustainability of the community as both lots were sold to financial institutions.

SALE – Achaglass was sold to Gresham House Forest Fund I LP.

ASSESSMENT – No difference.

CONCLUSIONS

it is unlikely that the sale of any of the above landholdings would have been affected by the Land Reform (Scotland) Bill had it been enacted and been law in 2020. In nine out of the thirteen sales, there would almost certainly have been no impact and in the other four, the likelihood of any impact are assessed at 5, 10, 15 and 20% respectively.

The sales include two landholdings being sold by Scottish Ministers in which their powers of intervention would have represented a clear conflict of interest but which is not reflected in any of the provisions of the Bill. The sales also include at least one landholding that would not have been caught by the provisions of the Bill (Kildrummy) even though it perhaps could have been the one most usefully broken up.

Others may take a different view of the likelihood of any impact and you are welcome to do so in the comments.

Overall, this analysis bears out my initial assessment that the Bill is unlikely to have much impact on Scotland’s pattern of private landownership in respect of the powers of intervention set out in Sections 2 and 4 of the Bill

Many Thanks for putting this into an accessible place. I am interested in the Kildrummy sale taking the form of selling shares in a Jersey based company, rather than a sale of land in Scotland. Does this mean that anyone wishing to evade land reform of land sales can simply place the land in the ownership of an offshore company and sell the shares, and so fall outwith any legislation passed by the Scottish Parliament?

That’s correct although they would have to do it before the legislation is in force

Presumably there are technocrats in the civil service drafting this stuff. They must surely know that this is just a waste of time and effort. Why bother at all? Driven by the Ministers or the Civil Service?

Worth noting that almost the entirety of Glen Spean Estate is under crofting tenure, being the Galmore Common Grazings.

As such there was (and remains) potential for a Part 3 CRTB purchase at any time.