Banking in an independent Scotland

John Swinney writes a long piece in today’s Daily Record (1) on the Barclay’s rate-rigging scandal. He says a lot about Labour’s past failings but nothing about his own plans for banking reform and merely concludes that

John Swinney writes a long piece in today’s Daily Record (1) on the Barclay’s rate-rigging scandal. He says a lot about Labour’s past failings but nothing about his own plans for banking reform and merely concludes that

“If we are to learn the lessons of the boom years, the banking collapse of 2008 and scandals like this one at Barclays must become an opportunity to build a better banking system.”

Well, yes. But two questions remain to be answered in respect of banking in an independent Scotland. (2)

In Swinney’s Glasgow Caledonian University speech on 11 June 2012, he says virtually nothing about monetary policy aside from welcoming the demise of the FSA. In future, the Bank of England will regulate banks and financial services. Under the SNP’s proposals to remain in the Sterling zone and regulated by the Bank of England after independence who will have legislative authority over the Bank? Two independent legislatures cannot each have autonomy and so there will have to be some kind of international treaty (like the Treaty of Maastricht which established the Euro). Â Which leads to the second question.

What kind of banking reform does John Swinney and the SNP have in mind? In the view of an increasing number of economists and others our monetary and financial system is fundamentally flawed because we have handed over the privilege of money creation to private commercial banks who now control 97% of the money supply (3). No wonder the LIBOR rate is set by a cartel of private businesses – they own our money.

Monetary reform is vital in an independent Scotland. Luckily for us, some good folk have been hard at work already. Positive Money has not only just published an excellent report on Democracy and Banking (which answers most of John Swinneys concerns) but has also (thank you, thank you…) drafted a Bill on a reformed Bank of England.

Now, let us be honest for a moment. Such a Bill stands next to no chance of becoming law whilst the British state has been captured by the feral elites of global finance. But, an independent Scotland could follow the recommendations of the Banking vs Democracy report and create an independent Scottish Central Bank.

Scotland would then become a beacon of progressive reform.

Unless it too has been captured by the high priests of Mammon?

(1) a similar text is published on SNP blog here.

(2) I should stress that the Barclays debacle and widening crisis of confidence in the City of London poses an equally serious challenge to the political credibility of Alastair Darling and the Better together campaign.

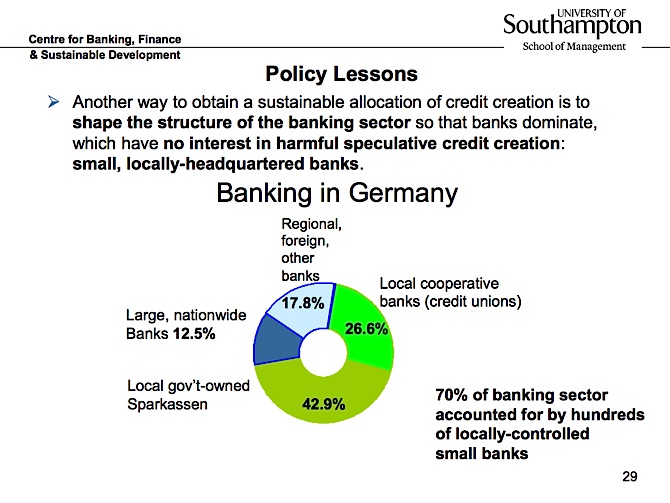

(3) It is worth contrasting the British banking system with that of Germany – a country I think Scotland would be far better to emulate that the UK. below is a graphic showing the breakdown of the banking sector with 70% of banks being owned by local authorities (Sparkassen) or credit unions, co-ops and mutuals. Thanks to Professor Richard Werner for the image. Professor Werner’s talk at the recent justbanking conference can be seen here – well worth a listen.

On Germany’s small banks- why do they repeatedly crop up as willing buyers of the duff CDOs being peddled by the feral elite banks? What difference to the corrupt and bankrupt network of Caixas in Spain? Germany’s industrial success hides a lot of faults in its financial sector too.

Scotland, sadly, stopped making anything too long ago for it to be an independent entity of any relevance.

I’m not sure that Germany’s small banks crop up in the manner you suggest but the large ones do – Deutschebank for example. But the Sparkassen? I doubt it.

Oh yeah? Land reform and all of a sudden no need to ship lamb, beef and poultry half way round the world, we really only need to produce enough for us, whilst investing North Sea income in education intellectual capital and new industry, from little Acorns…………..and all that!

It’s not a subject I know *anything* about but my gut reaction is that, while “locally controlled small banks” sounds all very touchy-feely and what’s not to like in contrast to bloated capitalist Barclays, RBS et al, what happened with all those small local banks in Spain that needed bailing out recently? (That’s not a rhetorical question, I genuinely don’t know.)

And while we’re talking about “locally controlled small” in a banking context, does anyone remember Western Isles Council losing a whack of money with that Middle East bank that went bust (I forget its name now)?

My point is that “small and locally controlled” is not *necessarily* good.

My understanding is that most of the Spanish “savings banks” morphed into riskier banks proper rather like Building Societies and savings banks in UK. They also had seats on boards of corporations and indulged in risky lending to property and other assets. German Sparkassen remain genuine savings banks thus the argument holds. Western Isles Council had its funds invested in BCCI – had it had funds invested in a locally owned bank it would have been far less likely to have got its fingers burnt. Small and locally-controlled on the German model works in Germany. it used to work in UK before Competition and Credit Control abandoned in early 70s and 1981 Big Bang in the city and the demutualisations of the 1980s. Last time I looked Nationwide and the Co-op bank are doing just fine thank you very much.

It was the Bank of Commerce and Credit International (BCCI) and it caused great difficulties here. However, the council eventually got its money back.

Interesting. What do the German local banks invest in?

The problem with the big UK banks IMO is the ambivalence that results from the fact you don’t pay for their services. (I mean not in a direct, upfront sort of way.) There would be a different “culture” if, instead of them all trying to make their money ripping you off in underhand ways they hope you’re not going to find out about, they just said a current account with RBS costs £25 (or whatever) a month and this is what you get for that. That way, everyone would know where they stand.

Retail banking is not the problem. 97% of money supply is created out of nothing by private banks via debt-based money. Every night the balance sheets have to be made up (which is the LIBOR function). It is this huge increase in the money supply and vast private indebtedness that has meant that very little productive investment takes place in the UK. German banks have been the principal investors in German industry helped by the fact that capital has not been squandered on land value bubbles – 56% of Germans live in long-term secure rented accommodation.

Not sure I would agree that there’s not a problem with retail banking but anyway …

The discussion appears to be fairly narrowly focused on investment banking versus regional and local retail banking. I would suggest that one needs to think more along the lines of member-controlled and mutual ownership of financial instruments. The UK’s problem has been politicians, government and the finance industry’s obsession with merge and acquisition to create bigger profits and bonuses for chief executives and boards. This has killed the diversity of the UK financial sector particular during the Thatcher regime.

However in other parts of the world cooperative and mutual financial institutions serve both their members and their communities well. For instance cooperative insurance in 2008 controlled 24% of the global insurance market (i.e. Netherlands, Germany, USA, France and Japan). While during the 2008 global financial crisis cooperative banks provided millions of people stability and financial security because the cooperative banking model emphasises not profit maximisation but instead the best possible products and services to members.

Other innovative financial models are the Canadian and US Solidarity Funds where trade unions and employees of small and medium size enterprises agree a social contract based on: acceptance of the rights of workers to form trade unions; continuous training of the workforce; and a fair return on investment and the creation of jobs. Based on this contract employees and trade unions through the solidarity fund invest in local business. The Quebec Solidarity fund over a period of 20 years created over 19,000 new jobs.

Other citizen financial innovations that would be of benefit in Scotland is the capacity for local authorities to invest in industry and job creation via public works. In the US local government can by a vote of the local residents agree to take out longterm investment bonds to pay for public infrastructure – schools, roads, etc. The Germany local state model where local government invests in key industries that are important to its posperity should also be considered. VW and other engineering companies have significant local government investment and in turn have to take note of local government’s views on investment. Only Orkney and Shetland Councils have the capacity and funds to undertake this kind of local industry investment.

In Scotland we need to think beyond the City of London investment and retail banking model. It is a scam on the taxpayer and customers and rotten to the core. It can not and will not be reformed by Unionist politicians in Westminister. They are completely integrated into the scam and benefit enorously from it. The way forward for Scotland is to do what we have in the past learn from our global neighbours and innovate new financial models that create equitable returns, sustainable growth and decent jobs.

Unfortunately Positive Money UK does not understand banking as well as they claim to do and too many others are falling for the mistaken belief that banks (other than the central bank, that is) are able to create money out of nothing. Should it take a socialist to remind folk of the fundamental truth that ALL wealth is created by Nature and human labour involved in its transformation into commodities? Its the basis of Marx’s Labour Theory of Value. Wealth cannot be created from key-stroke of a bank’s computer (and when the central bank raises the money supply, prices of goods – (but not their value which is incorporated in the necessary socially labour time involved in their production) – simply rise through inflation).

Money/cash notes (M0) is not debt based – and so what if only 3% is in circulation – thats the purpose of money – to circulate – Duh. Only the creation of M3 and M4 money is debt based. M0 is indeed different to M3/4. We need M0 to create M3/4. There is a direct correlation. M3 and M4 is created by banks which use the cash they have received by depositors to make loans. New loans depend upon deposits. Without a deposit to lend there can be no loan. (Banks can, of course, borrow like anyone else and re-lend)

Many economists merely use “out of nothing” to provide a simple way to explain the different measures of the money supply but the result is they are quoted out of context and people think banks really can just print money willy-nilly.

What bank reformers who seek the abolition of fractional reserve banking such as Carswell/Positive MoneyUK is doing is suggesting that banks offer safe deposit box style accounts, in which the cash you deposit can’t be lent out. Not very radical.

See this discussion thread on the topic of banking

http://www.worldsocialism.org/spgb/forum/general-discussion/100-reserve-banking

Or try these articles

http://www.worldsocialism.org/spgb/socialist-standard/2010s/2012/no-1290-february-2012/where-money-comes-reply-new-economics-foundation

http://www.worldsocialism.org/spgb/socialist-standard/2000s/2009/no-1253-january-2009/banks-money-and-thin-air

http://www.worldsocialism.org/spgb/socialist-standard/2010s/2012/no-1293-may-2012/cooking-books-banking-demystified-again

The Socialist Party of Great Britain will be debating Positive Money UK at Conway Hall, London on Wednesday 5th September at 7.00pm and a video will be available shortly after for thoe who will not be able to attend