Climate Finance and Carbon Offsetting

On 1 March 2023, NatureScot announced a £2 billion private finance pilot designed to secure landscape scale restoration of native woodlands.

The project involves NatureScot and private companies Hampden and Co., Palladium and Lombard Odier Asset Management Europe) Ltd.

NatureScot has provided me with a copy of the Memorandum of Understanding (MoU) with the agreement of the investment partners. It is worth a read – it is only 5 substantive pages.

In the MoU, signed in February, the parties agree to explore the potential for a significant investment in woodland creation in Scotland focussing on the Scottish Borders and the Atlantic Rainforest.

The parties aims are inter alia to “catalyse private investment into the project at significant scale”, to deliver “high integrity carbon investment”, demonstrate how government policy and subsidy support can enable private investment into nature restoration” and “maximise the benefits for nature and communities from the investment”.

Hampden and Co will provide finance for the project via Special Purpose Vehicles (SPVs).

Palladium will design the project, establish SPVs and lease with partners on the ground to agree terms of investment and carbon contracts.

Lombard Odier Asset Management Europe) Ltd. will be responsible for selling carbon credits.

The project will provide financial returns for landowners and investors whilst claiming to “deliver significant and lasting community benefit“. See the NatureScot media release for a full FAQ on the project

This blog is not so much about this project which will at least provide some greater transparency around how carbon markets may evolve in Scotland but about the assumptions and policy decisions which appear to lie behind it and other activity undertaken by Scottish Ministers to promote carbon markets and private investment.

Carbon Offsetting

Scottish Ministers have stated an ambition to develop carbon markets in Scotland as a means of securing private investment in nature restoration and contributing to the statutory net-zero climate targets. Offsetting is the means by which polluters can buy carbon credits to offset their emissions. Carbon credits are typically sold by brokers on behalf of landowners whose management activities (such as tree planting and peatland restoration) lock up carbon or (in the case of peatland restoration), curb existing emissions.

The development of a carbon market is seen as key to attracting the kind of investment represented by the financiers behind this project as as has already taken place by financial companies such as Aviva and Standard Life.

The problem with this whole approach is that there has been no comprehensive assessment made of to what extent carbon offsetting should be part of Scotland’s net-zero plan. Every ton of carbon that is sequestered by woodlands (for example) and offset against emissions by cement factories or fashion companies, is a tone of carbon that is contributing nothing in the long term to net-zero since it has been sold as an offset to a polluter enabling them to continue polluting.

How much of Scotland’s land shoudl we allow to be used for this purpose?

No answers have been forthcoming from Government and yet it is a central player in this market since it provides the key means of validating claims about carbon credits through its Woodland Carbon Code and has provided guidelines for investors through the Interim Principles for Responsible Investment.

In the FAQ associated with the project, NatureScot claim that carbon offsetting is an important part of global agreements on climate change. However, there are no legally-binding agreements in place that govern who can use offsetting. The MoU claims that an ethical framework will be developed to ensure that offsets are used only by “legitimate businesses who have credible carbon reduction pathways in place”.

Even more fundamentally, even if offsetting is a legitimate means of companies with unavoidable emissions achieving net-zero, why should then be expected to acquire offsets rather than simply, for example, having their emissions assessed by Government as unavoidable. Such registered emissions would then be accounted for within national carbon budgets with no need for a private, unregulated market in carbon offsetting.

The £20 billion finance gap

Central to the Government’s argument is the so-called “finance gap for nature”. In NatureScot’s media release, the Minister, Lorna Slater is quoted,

Biodiversity Minister Lorna Slater said: “The finance gap for nature in Scotland for the next decade has been estimated to be £20 billion. Leveraging responsible private investment, through valuable partnerships like this, will be absolutely vital to meeting our climate targets and restoring our natural environment. Scotland is well placed to take a leading role by offering investors the opportunity to generate sustainable returns from the restoration and regeneration of our landscapes. This investment will generate multiple benefits: ending the loss of biodiversity, improving water quality, reducing the risk of flooding, regenerating local communities and creating green jobs.”

What exactly is this £20 billion finance gap? The figure derives from a report published by the Green Finance Institute, an “independent, commercially focussed organisation backed by government and led by bankers”. In the “Finance Gap for UK Nature” report, published in October 2021, the gap between required spending and committed spending by Government to deliver nature restoration is claimed to be between £44 and £97 billion. For Scotland, the gap is £15-£27 billion with a central estimate of £20 billion.

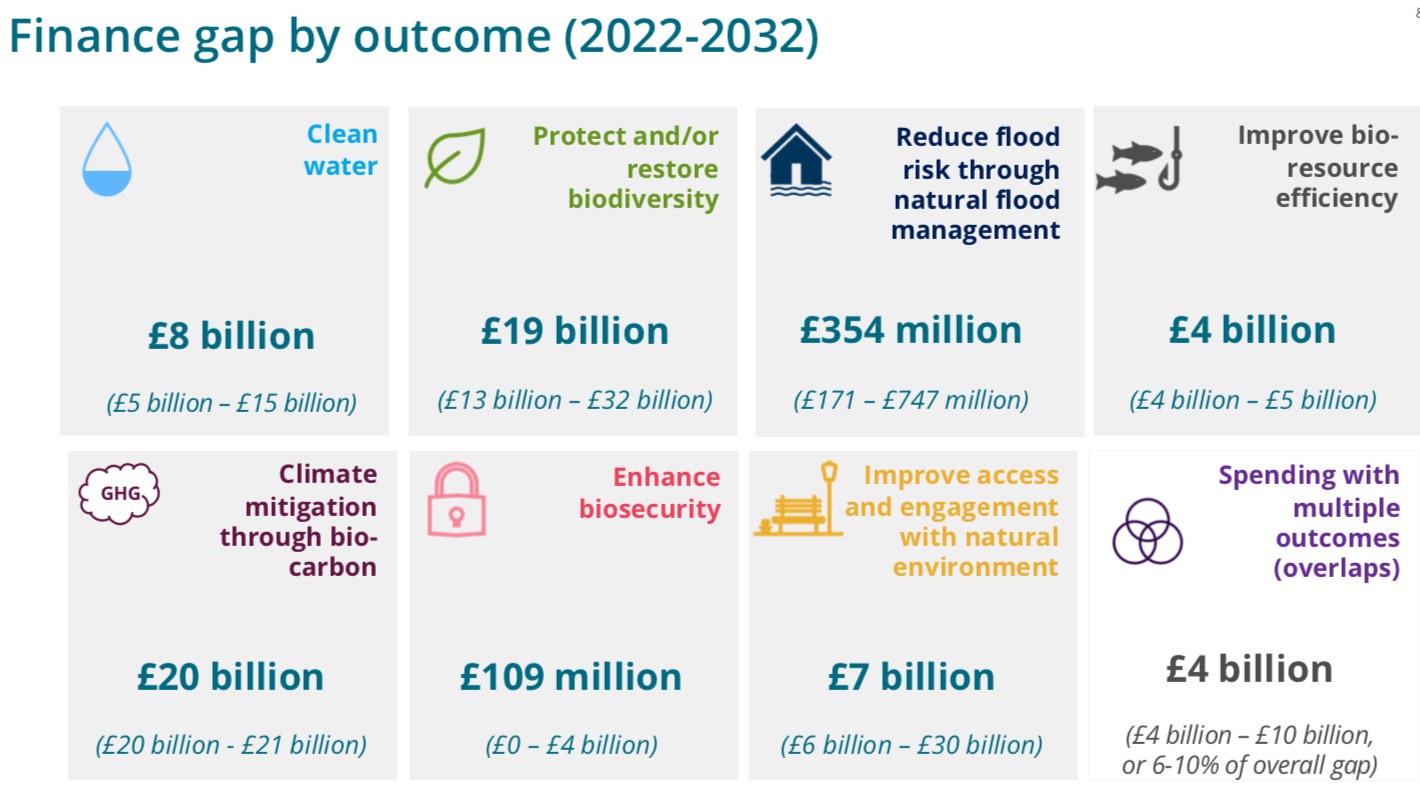

The nature-based outcomes covered by this gap are illustrated below (figures are UK-wide).

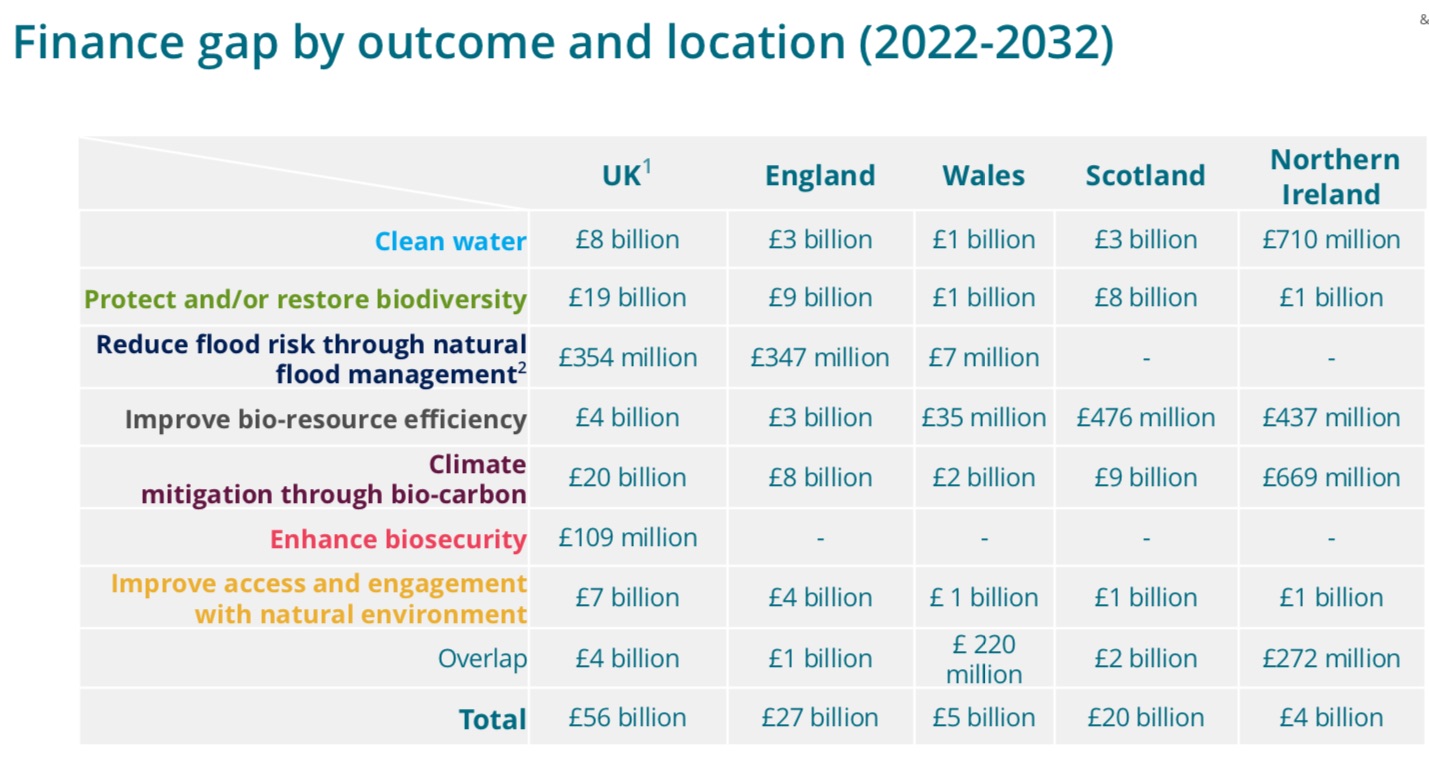

The breakdown in the finance gap for Scotland is illustrated below.

The finance gap thus covers a wide range of outcomes of which, for Scotland, the largest (£9 billion) is climate mitigation through bio-carbon). The second largest is the protection and restoration of nature (£8 billion). Woodland creation is only one part of this with others including protecting endangered species, restoring freshwater habitats, ensuring seafloor habitats anre healthy and sustainable and achieving biodiversity net gain.

Should we be planting trees?

Of the £20 billion finance gap, £8 billion is for the restoration of habitats and only part of this (the Finance Gap for UK Nature report provides no further breakdown) is for woodland creation and management.

In addition to the unanswered question of what role (if any) offsetting should play in Scottish climate finance, is the question of whether we even need all of this private investment in the first place. Clearly we do need private investment. Over 85% of Scotland is privately-owned and the public is not in a position to make all the investment that is required.

It is at this point, however, that there appears to have been no detailed analysis by Government as to how nature restoration could be supported. Instead, it has jumped onto the rapidly growing carbon offsetting model.

There are alternative means of restoring nature. Here are some.

- Landowners could be placed under legal obligations to restore nature (the damage to which has been caused in large part through their management activities) through the tenure system or through policy instruments such as the Land Rights and Responsibilities Statement.

- Government could implement the recommendations of the Deer Working Group to reduce wild deer densities to the level required to allow forest regeneration.

- Reform agricultural support to require nature restoration as a condition of agricultural subsidy.

- Strengthen biodiversity gain through the planning system.

- End damaging actives such as muirburn.

- Reform land and property taxes to deliver woodland, water and peatland restoration

Regulating existing ownership and use of land in ways designed to restore nature and contribute to net-zero has huge potential to achieve nature restoration goals. Much of this will be at no cost to the public purse and will not involve global financial corporations becoming partners in any such activity.

Currently, government is sleep-walking into a future of global capital and carbon markets with no clear policy on whether and why offsetting should even be supported and no clear plan as to the extent to which alternative policy measures could deliver landscape scale nature restoration.

This blog has been supported by donors to my defamation crowdfunder who kindly donated their eligible refunds to my work on land reform.

Great article.

As you remind us “……this whole approach is that ………..Every ton of carbon that is sequestered by woodlands (for example) and offset against emissions by cement factories or fashion companies……… has been sold as an offset to a polluter enabling them to continue polluting.”

What does the ScotGov think the polluting companies are using the credits for?

It “looks” especially good for a photo-op here in green Scotland if the pollution is happening in some other country, far away.

It is time more people woke up to this carbon credits con. An alternative solution is to ‘make polluters pay’ a longstanding principle which could be implemented by carbon tax.

carbon credits are an asset that are sellable (and presumably tax generating for Scotgov) so an income stream for Scotgov. I agree they are not helpful in a NetZero context as it prolongs pollution elsewhere, but until the scheme ends it seems to make sense to take advantage of it

Carbon trading is the biggest fraudulent racket in my lifetime. It does nothing to reduce the effects of climate change going forward. It allows multinational and large corporate bodies to continue polluting the planet. At the heart of this is money!!!! There is no doubt about that, and it is making a lot of people very rich. For the good of mankind, a stop should be put to this, right away.

This will be very difficult because right at the heart of this is the Scottish Government and the Green Party, but someone somewhere must have the ability and guts to put a stop to this, because it is costing the tax payer an arm and a leg. Covering Scotland in trees is definitely not the answer. There are many other ways to achieve this, and they should be explored.

I cannot understand how carbon offsetting actually helps us reduce carbon dioxide pollution in the short term. We all know that trees take time to grow (say 20 years) to a size that will make any difference to carbon dioxide reduction so in the meantime there is very little actual carbon offsetting. I believe “net zero” is more of an accounting exercise than an actual reduction in carbon emissions .

A future consequence of this policy is shown by the recent purchasing ( sight unseen) of a farm in Moray by an investment company Foresight Sustainable Forestry with the intention of planting trees on 348 acres of good agricultural land. This land had produced good returns of barley and other crops.

How much good agricultural land is going to bought up by these investment companies who have no interest in the land and the community except to use the land to make a profit from these carbon credits . Remember the Flow country planting back in the 70’s.

Rod, which farm has been bought in Moray?

Andy , Mains of Blairmore in Huntly / Keith area

Ah OK. Mains of Rhynie also been sold to Aberdeen company for tree planting.

This is a worrying trend as I pass that farm and it has good agricultural land for growing arable food crops. If this continues without any checks then Scotland will soon be importing all its food even turnips! The Scottish government should remember we can’t eat trees.

Regarding your list of alternative means of restoring nature. Plainly these could reduce the purported ‘funding gap’ but it’s worth bearing in mind that many do not simply transfer the cost to the landowner. For example, the prevailing model assumes that trees must be planted but in many – not all – places they do not. Just let succession succeed. Of course it is not quite that simple, mainly because of deer. But why oh why do we always assume that intervention is needed. I’m no fan of Ronald Reagan, but as an ex-civil servant familiar with moral hazard I’ve always liked the phrase attributed to him: ‘Don’t just do something, stand there!’

Thank you Andy and I am left wondering about how it could possibly be that “Currently, government is sleep-walking into a future of global capital and carbon markets with no clear policy on whether and why offsetting should even be supported and no clear plan as to the extent to which alternative policy measures could deliver landscape scale nature restoration”. Like you I cannot find any clear policy on offsetting and given that climate finance was such a key part of the Glasgow COP26 agenda, and the CCC see it as such a key part of the battle against climate change, it seems strange that this is the case. Can you say more about why you think there is such an apparent huge gap in Scottish policy – or is work going on behind the scenes that you are aware of the close the gap?

One problem with planting trees to offset emissions is that the carbon sequestered needs to be counted in some way and those investing want a return. The best kind of tree-planting to achieve this is to create plantations of single species, and plantations are not forests in the ecological sense.

Then what happens when those trees are fully grown? They are harvested. If they are then burned as biomass all that tree carbon is returned to the atmosphere. Then there’s the soil carbon losses from plantation harvesting and re-planting to consider. Offsetting carbon emissions by planting trees is, as people have said above, an accounting excercise; it distracts from making real changes to how we live – primarily by consuming less.

Addressing climate change and biodiversity losses can only be done slowly, by restoring whole landscapes, with mixed species of trees (ideally native species with a good tolerance for increasing temperatures), with a flourishing understorey, and undisturbed soils. Nature knows how to sequester carbon, it knows how to create habitats. I’ve yet to see evidence that carbon markets can acheive similar – or even want to.

I agree 100% with Rob, the Scottish Government policy appeared to be TREES AND TOURISM. iI pointed out on radio program 2 years ago that we coudn’t eat trees and there would be no views to attract tourists – quite apart from midge hell and risks of fire across Scotland- but I got rapidly cut off by presenter. Surely now with war highlighting insecurities in food, energy etc , we should be looking for resiliance and self sufficiancy.

On the Woodland Carbon Code, recent work has been carried out to make remnant ancient woodland sites eligible for carbon credits in the same way as woodland creation projects are. See https://zuluforest.com/insights/Lost-Woods. As with most things, the mindset behind any project is what will determine whether it is truly for nature or just for profit.

Thanks for the article Andy,

I’ve no doubt the alternatives you suggest would be more successful at delivering the intended outcomes than the climate financing and carbon offsetting model we are currently pursuing. Unfortunately your suggestions are focussed on tackling the underlying issues facing landscape restoration rather than making profit for potential investors, so may not be welcomed with open arms.

Just to note, in the ‘finance gap by outcome and location’ table, the largest finance gap in Scotland is climate mitigation through bio-carbon (£9 billion), not improve bio-resource efficiency (£476 million).

Keep up the good work.

Thnaks for pointing that out. Corrected now.

Is there some other model of land restoration/rewilding that circumvents the carbon offsets model.i am not sure what is being proposed here but it sounds like tree planting more or less along the lines of forestry commission/estate planting of commercial species. I suppose legislation would be required. Is there any activity/working group that promotes a more sustainable model. I suppose I have in mind ‘trees for life’ or some development of that approach.

No doubt Ministers will claim their approach is ‘world-leading’ – a phrase they fix to most policy areas they consult on. It’s vacuous and should be binned now (like their fascination with private and inward investment targets).

What Scotland, or any society needs, is government which produces policies and systems that achieve sound outcomes for the wellbeing of their citizens and the environment – practical solutions that work within a reasonable timescale, or on a sensible course to a longer term agreed destination; they could well not be world-leading, just competent.

Looks like a very large horse in the shape of the monetising of our natural capital is sallying out of the stables right now. Good luck if you’re a community trying to do your own wee bit to help biodiversity and foster land reform initiatives.