Land Reform (Scotland) Bill (5)

This is the fifth in a series of blogs analysing the Land Reform (Scotland) Bill 2024.

In this blog I want to continue analysing the potential impact of the intervention powers (Sections 2 and 4) in the Bill by looking at qualifying land (>1000 ha) that has been sold over the past few years. I will examine each land sale in turn and assess how likely it would have been that the Bill would have changed anything had it been in force at the time. In previous blogs I looked at 2020 and 2021. In this one I will examine land sales in 2022.

An overall analysis of the land market 2020 – 2022 can be found in this report I published in February 2024.

The Bill obliges any owner of land in excess of 1000 ha where they propose to sell all or part of it, to notify Scottish Ministers. Ministers can then do two new things – invite an application fo a late registration under the community right to buy provisions of the Land Reform (Scotland) Act 2003 and make a lotting decision to potentially require the land to be sold in specified lots. See previous blog for more detail.

Cambusmore Estate (Sutherland)

4464 ha. Sold 1 February 2022 for undisclosed sum and again in December 2022.

CRTB – the first sale was an off market sale and the community would have been notified of this were there a community body in existence. I am not sure if there is or was. The estate was sold for many millions and then the larger part was sold again in December.

LOTTING – Ministers would have been unlikely to lot the land in the second sale as it already being sold in lots

SALE – it is not yet clear who has bought the majority of this estate.

ASSESSMENT No difference.

Abergeldie Estate (Aberdeenshire)

4703 ha. Sold 18 March 2022 for an undisclosed sum (was on the market for £23 million).

CRTB – this was an open market sale. Any community body that existed could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – The esate was sold as one whole though there are 34 separate residential properties. Ministers could have chosen to make a lotting decision to specify different lots and this might have made a difference to the sustainability of the community but only if the properties could have been successfully bought by local interests. There is no control who would buy separate lots and it is up to the seller to decide who the successful purchase is/

SALE – the estate was sold to Caerd Ltd.

ASSESSMENT 5% likelihood of making a difference.

Westloch Farm (Peebles)

1030 ha. Sold 1 June 2022 for £13,206,450

CRTB – this was this was an open market sale. Any community body that existed could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – Ministers could have chosen to make a lotting decision but it is considered unlikely that it would have made any difference to the sustainability of the community.

SALE – The estate was sold to the Auchencairn Forest LLP, owned by John Harz of Inflexion Private Equity Partners.

ASSESSMENT 5% likelihood of making a difference.

Far Ralia (Inverness-shire)

1462 ha. Sold 14 July 2022 for an undisclosed sum.

CRTB – this was (I think) a private sale. An advance notification might have persuaded any community body to submit a late application. However, it is unlikely that a case could have been made for a late registration.

LOTTING – Ministers could have chosen to make a lotting decision but it is considered unlikely that it would have made any difference to the sustainability of the community.

SALE – The estate was sold to ABRDN Property Income Trust based in Guernsey.

ASSESSMENT No difference.

Auch Estate (Argyll)

3747 ha Sold 30 September 2022 for an undisclosed sum.

CRTB – this was an open market sale following ion from the sale of the neighbouring Invermean Estate (see previous blog). The sales brochure can be downloaded here (4.7Mb pdf). Any community body that existed (there are none) could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – Ministers could have chosen to make a lotting decision but it is considered unlikely that it would have made any difference to the sustainability of the community.

SALE – the estate was sold to Profound UK Holdings Ltd., a company ultimately owned by Mr Ming Wai Lau, Chair of Chinese Estates Holdings Ltd. and a resident of Hong Kong with British nationality who had already acquired the neighbouring Invermearan Estate.

ASSESSMENT No difference.

Glen Prosen Estate (Angus)

3440 ha Sold 10 November 2022 for £17,555,000

This was a private sale to Scottish Ministers. Any notification of the sale to Scottish Ministers when they were seeking to acquire the estate themselves presents a clear conflict of interest. In the absence of any provisions in the Bill as to how this will be dealt with, no assessment is made of the impact of the Bill on this sale.

Invergeldie Estate (Perthshire)

4776 ha. Sold 3 December 2022 for £20 million.

CRTB – this was an open market sale. The sales particulars can be downloaded here (5.5Mb pdf) and the plan here (1.9Mb pdf). Any community body that existed (Comrie Development Trust for example) could therefore have submitted a late application to buy the land. The Bill provides no new powers.

LOTTING – Ministers could have chosen to make a lotting decision but it is considered unlikely that it would have made any difference to the sustainability of the community.

SALE – the estate was sold to Invergeldie Conservation Ltd., a wholly owned subsidiary of Oxygen Conservation Ltd.

ASSESSMENT No difference.

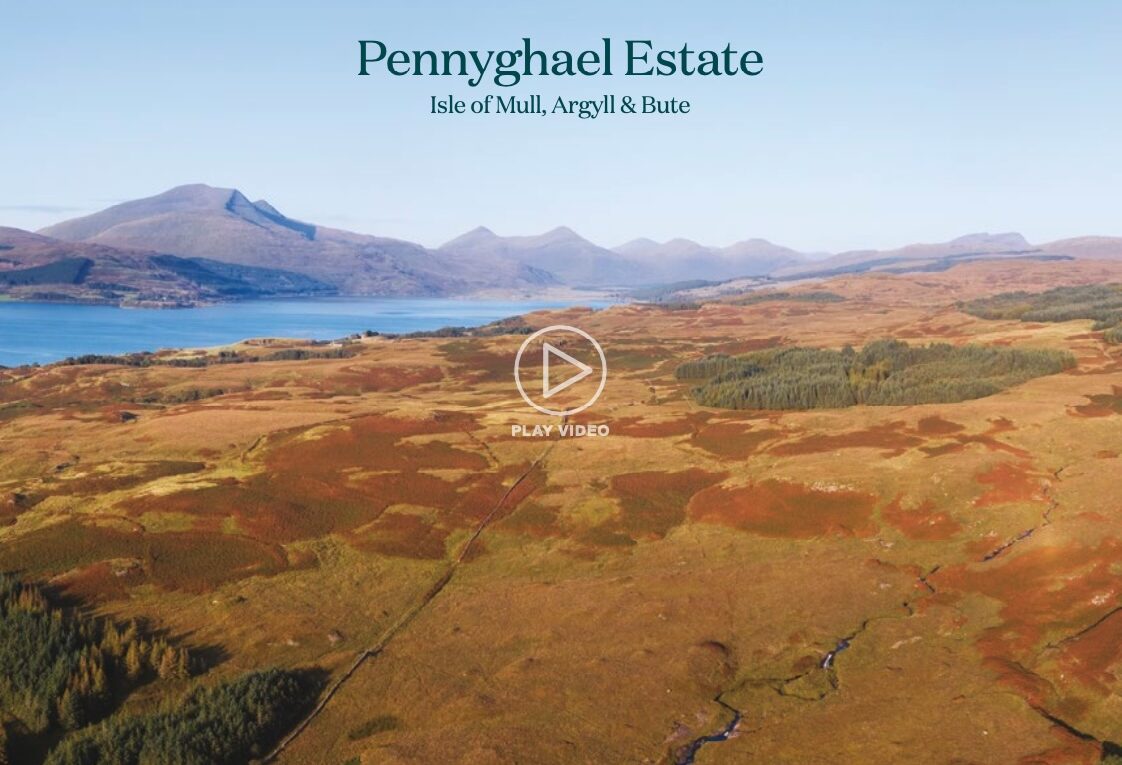

Pennyghael Estate(Argyll)

3535 ha. Sold sometime in 2022 for an undisclosed sum.

This was an open market sale. The sales particulars can be downloaded here (4Mb pdf). This sale was by virtue of thre acquisition of the share capital of the the Dutch company that owned it (Participatiemaatschappij Epsilon NV) and thus is out of scope of the provisions of the Bill. The intervention powers do not apply to the sale of share capitcal of any company owning land. The share capital was acquired by Foresight Inheritance Tax Solution (Foresight ITS)

CONCLUSIONS

It is unlikely that the sale of any of the above landholdings would have been affected by the Land Reform (Scotland) Bill had it been enacted and been law in 2021.

Others may take a different view of the likelihood of any impact and you are welcome to do so in the comments.

Overall, this analysis bears out my initial assessment that the Bill is unlikely to have much impact on Scotland’s pattern of private landownership in respect of the powers of intervention set out in Sections 2 and 4 of the Bill. Of the eight sales, four were to owners who already owned extensive areas of land across Scotland.

Interesting analysis Andy.

Something that concerns me is the prohibitive effect the CTRB part will have on sales of small areas from large estates.

Say a residential tenant on one of those estates had approached the owner asking to buy their home. Or an owner-occupier next to the estate asked to buy a little extra garden ground. If the Bill were law the estate would be legally obliged to refrain from discussing that until they have applied to the Ministers and received permission (timescale: unknown). Why would they do so without a price already being agreed? How long will the tenant have to wait to find out that – surprise surprise – no community body is going to be set up to buy their house? (Meanwhile his mortgage offer has expired.)

In the garden ground example, realistically the estate will see it as not worth the bother so it will never happen. So the estate will remain intact – the opposite of the goal to increase diversity of ownership.

Are stakeholders alive to this do you know?

This is a good point. It is partly why I criticise the Bill for intriducing too much bureacuracy. Som large holdings sell 10-20 plots of land every year. All will, as you correctly point out, have to be notified. This is an important point to make in responding to the consultation by the Committee.