Who Owns Scotland 2025

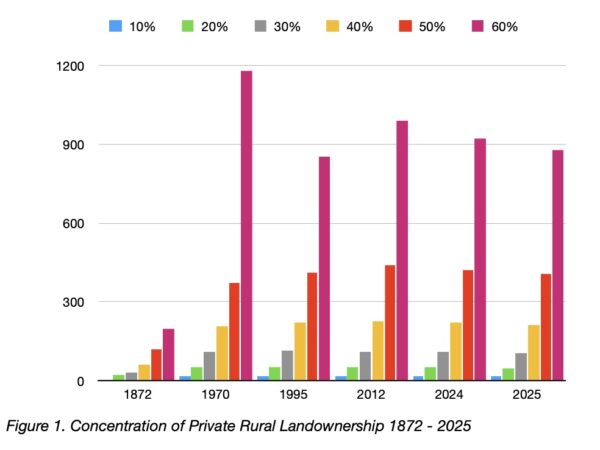

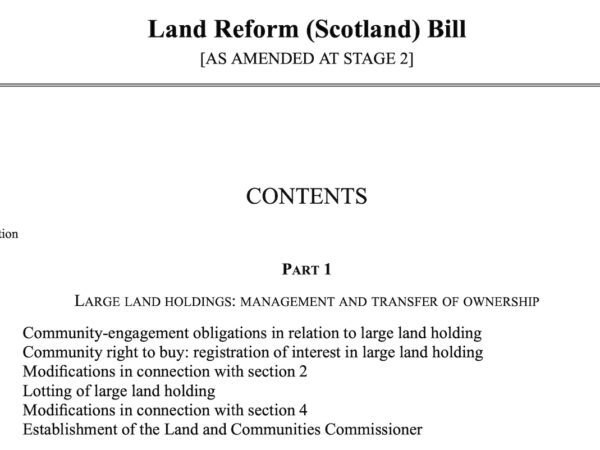

SCOTLAND’S CONCENTRATED PATTERN OF LANDOWNERSHIP CONTINUES TO GET WORSE Today I publish Who Owns Scotland 2025, the second annual report on landownership in Scotland. The first (Who Owns Scotland 2024) was published in March 2025. In addition to a high

Continue reading